Introduction

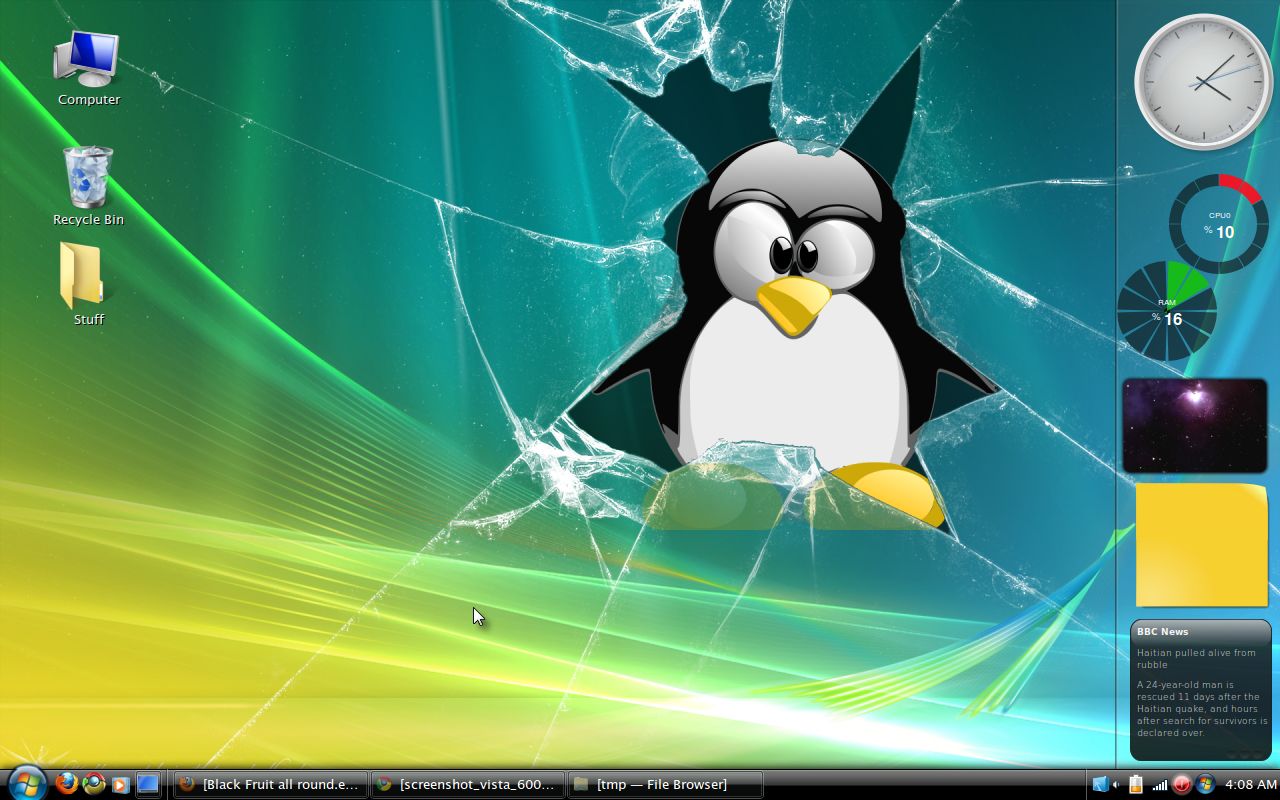

What are the risks of dual booting Windows and Linux? Dual booting Windows and Linux on the same machine is an attractive option for those who want to have the best of both worlds. Having two operating systems in one device can provide flexibility and convenience, but it’s worth considering potential risks and understand how a dual boot environment works before taking the plunge.

Exploring the Pros and Cons of Dual Booting Windows and Linux

Dual booting Windows and Linux has both pros and cons. On the one hand, it allows users to enjoy the convenience of accessing two operating systems in one machine, so that different tasks and software can be easily accessed from either one. On the other hand, system partitions need to be carefully managed and if taken incorrectly, data could get lost or become inaccessible. Additionally, every installation of a new software needs to be done twice, creating a duplication of effort.

Read More: Why is Linux Slower Than Windows?

Pros:

- Access two operating systems in one machine

- Achieve greater flexibility

- Emergency utility

Cons:

- Partition management

- Duplication of effort

- Software compatibility issues

What are the risks of dual booting Windows and Linux?

One of the potential risks of dual booting is a mismatch between installed software and operating system versions, as this can create potential compatibility issues. Partial backups are also tricky as there is no easy way to restore both systems equally. Furthermore, if the systems are not properly partitioned, data could become corrupted, corrupted hard drive sectors could damage data, or a system could have difficulty booting.

Read More: Why do Linux distros still bother making their own packages when we’ve got Flatpak (or Snap)?

Risks to Consider:

- Software compatibility issues

- Partial backups

- Corrupted data

- Damaged hard drive sectors

- Boot issues

When it comes to dual booting Windows and Linux, users should consider the risks carefully and make sure to manage partitions and back up their data properly in order to avoid any potential problems.

Conclusion

Having a dual boot system that runs both Windows and Linux has undeniable advantages, especially in terms of convenience. However, if not set up correctly, users may face potential risks such as software compatibility issues, corrupted data, and damaged hard drive sectors which can eventually lead to data loss. Understanding the risks of dual booting before setting it up can help users navigate potential problems and ultimately, get the most out of their system.

Aleksandar Paunovski is a Computer Science student at New Bulgarian University. He has more than 20 years of experience with computer systems. Aleksandar knows PHP, JavaScript, C++, CSS, and HTML and is an expert on WordPress, computer security, Linux, Mac OS, Chrome OS, and Windows. When not busy making sites, Aleksandar loves to listen to 90’s music, walk in the park, and post on his blog.

[…] Read More: What are the risks of dual booting Windows and Linux? […]