Which is Better for a First-Time User: Windows or Linux? As a voyager embarks on a journey down the profound sea of the digital world, the first dilemma often emerges – which ship to sail? Should they hoist the flag of Windows, the titan of convenience, familiarity, and compatibility? Or should they take the helm of Linux, boasting the virtues of security, flexibility, and cost-effectiveness? This age-old digital enigma can bewilder even seasoned sailors. Hence, we step into this virtual Odyssey, weighing anchor on an exploration of first-time operating system (OS) choices. We’ll be navigating the choppy waters of Windows vs. Linux, guiding you in charting your course to that perfect digital harbor. Arise, future mariners, as the sea awaits us; let the voyage commence!

Decoding the OS Jargons: Understanding Windows and Linux

When approaching the vast world of operating systems for the first time, two names will invariably pop up – Windows and Linux. While Windows is the undisputed dominant player in the market, Linux has a loyal following and is esteemed for its flexibility and open-source nature. Both these systems have their unique strengths and features that make them ideal for different user bases. To demystify these often-confusing terms and make an informed decision, let’s dive into the distinguishing aspects of Windows and Linux.

Windows, crafted by Microsoft, boasts a user-friendly interface. It has a broad range of software compatibility and serves as the default choice for most businesses and home users. With Windows, you get comprehensive support, a rich ecosystem of software and hardware, and unmatched ease of use. Here are some of its hallmark features:

- Seamless integration with Microsoft products like Office Suite

- Accessibility features like the Narrator, Magnifier and Windows Speech Recognition are quite advanced

- Consistent updates ensure your system is equipped with the latest features and security patches

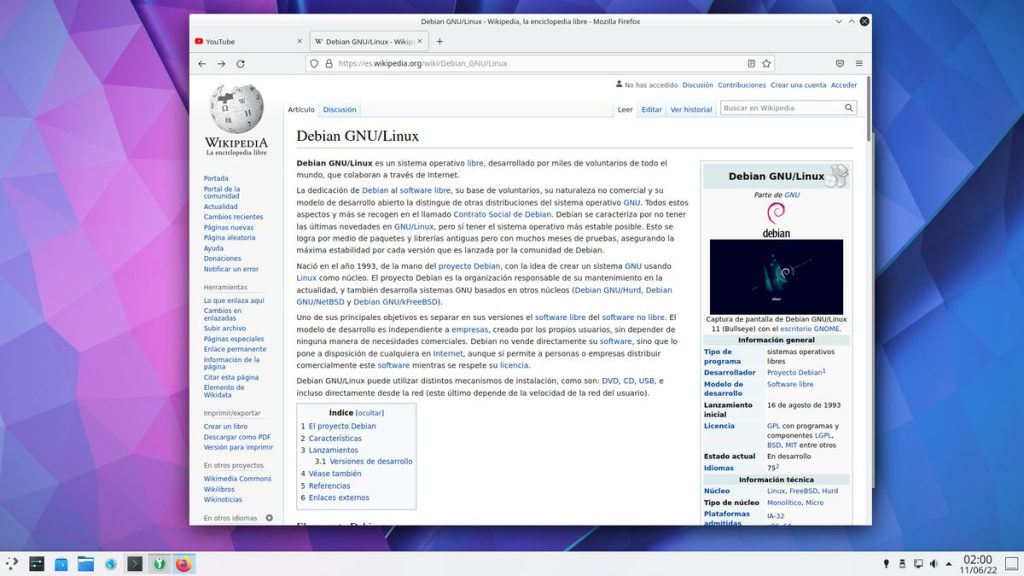

On the other side of the spectrum, we have Linux—an open-source operating system known for its robust security and flexibility. Linux is loved by developers and system administrators but might be a bit overwhelming for complete beginners. Here are some highlights:

- With shell scripting, you can automate processes, program jobs and perform batch processing

- Offer a number of open source applications for all user needs

- A powerful CLI (Command Line Interface) that you can deploy to manipulate the system extensively

| Operating System | User-Friendly | Software Compatibility | Security |

| Windows | High | High | Moderate |

| Linux | Moderate | Moderate | High |

The key is not to get overwhelmed, but to identify your needs and choose an operating system that fits those needs the best. Remember, there’s no ‘one size fits all’ solution when it comes to operating systems, and your choice should reflect your unique requirements.

Exploring a Novice’s Paradise: A Self-Guide to Choosing between Windows and Linux

Despite the various operating systems (OS) available, Windows and Linux continue to engage in a rendezvous of rapture for first-time users. For a novice, the decision can be utterly confusing. Here’s a self-guide to assist you in making an enlightened decision.

Let’s begin with Windows, a undoubtedly user-friendly choice. Used by millions worldwide, Windows is incredibly intuitive, even for a complete beginner. Compatibility isn’t an issue. Famous for its broad support for hardware and software, most devices and applications work seamlessly with Windows. Additionally, it delivers unmatched customer support. The downside, however, is the cost associated with its use, regular need for robust antivirus software, and occasional system sluggishness.

- User-friendly interface

- Vast hardware and software compatibility

- Excellent customer support

- Pricey licensing

- Regular need for antivirus

- Occasional system lags

On the other hand, Linux is open-source and therefore, free. This OS offers exceptional stability and security, virtually eliminating the need for antivirus software. Usually favored by tech-savvy users due to its flexibility and control, Linux could have a steeper learning curve for a novice. Additionally, Linux’s compatibility with certain software and hardware can be limited.

- Open-source, hence free

- High stability and security

- Limited software/hardware compatibility

- Steep learning curve for beginners

Here’s a snapshot comparison:

| Factors | Windows | Linux |

|---|---|---|

| Cost | Expense Involved | Free |

| Security | Regular Antivirus Needed | Highly Secure, Antivirus Not Necessary |

| Compatibility | Wide Range | Limited |

| Usability | User-friendly for Novices | Steep Learning Curve for Beginners |

In conclusion, your choice between Windows and Linux should be based on your needs and preferred user-experience. If you seek an intuitive design and superb compatibility, Windows might be your calling. But, for those seeking a secure, stable, and open-source OS, and don’t mind the steep learning curve, Linux could be the gem.

The Linux Experience: Why it’s not as Scary as You Think

Choosing to venture into the world of Linux as a first-time user can often seem intimidating or complex. However, once you overcome the initial learning curve, you’ll find that using Linux is not as scary as it might appear at first. While Windows remains the go-to choice for many due to its user-friendly interface, Linux shines in areas such as customization, stability, and security. To give you a clear understanding, here’s a comparison between Linux and Windows, in terms of a few key parameters.

| Parameter | Linux | Windows |

|---|---|---|

| Cost | Free | Charges apply |

| Security | High | Medium |

| Customization | High | Low |

Linux being an open-source platform, lets users take full control of their operating systems. It also proves to be a safer option with fewer vulnerabilities compared to Windows. Furthermore, it’s entirely free of cost!

- Customization: With Linux, you get to tailor your OS exactly to your preference.

- Security: Linux is known for its robust security. The open-source nature of Linux allows for quick bug fixes.

- Cost: Perhaps the most significant advantage of Linux is that it’s free. Unlike Windows, where you might have to purchase a license, with Linux, you’re off the hook.

Embrace the journey of learning a new system; the experience will only make you a computer savvy. Plus, you’ll be part of a massive online community ready to lend a hand when needed. Choosing an operating system ultimately boils down to your personal or professional needs. Regardless, getting started with Linux isn’t all that terrifying and is certainly worth considering!

Windows vs Linux: Dissecting Functionality, Flexibility, and Security

Which is Better for a First-Time User: Windows or Linux? Deciding on your first operating system (OS) can often feel like an overwhelming task. Let’s delve into the functionality, flexibility, and security aspects of both Windows and Linux operating systems (OS) and help you navigate a well-informed decision.

Functionality and Flexibility: For a user-defined experience, Linux outshines Windows. It allows users to finely tune their OS to their preference due to its microkernel-based open-source architecture. It supports a wide range of interfaces, from the desktop-centric GNOME and KDE to the command line interface. However, Windows provides a simpler and more interactive user interface, with few customizable options, but requires less technical knowledge to use.

Read More: Can two different operating systems be used in one system?

- Windows: Interactive UI, Few customization options, Requires less technical knowledge

- Linux: High customization options, Supports a wide range of interfaces, Requires more technical knowledge

Security: Linux, with its open-source quintessence, allows anyone to view, modify, and contribute to the code - leading to more eyes scrutinizing the code and a faster response to patch vulnerabilities. Meanwhile, Windows, being a closed source system, does not have such privilege. Its vulnerabilities get fixed only after their discovery by an in-house team or through a reported flaw by users. This leads to a gap in response time, making Windows more susceptible to attacks.

| OS | Security |

|---|---|

| Windows | Slower response to patch vulnerabilities |

| Linux | Faster response to patch vulnerabilities |

Windows or Linux, the choice of OS depends on what suits your requirements best. If simplicity and usability are your top priorities, Windows might be a better option. But if you seek high customizability and robust security, Linux becomes a very reputable choice.

Demystifying App Ecosystems: A Closer Look at Software Support

Choosing an Operating System (OS) for the first time can feel daunting given the number of options available. Typically, the choice boils down to two main contenders: Windows and Linux. Each of these platforms comes with its unique strengths and weaknesses, making the choice largely dependent on your specific needs and technical expertise. Which is Better for a First-Time User: Windows or Linux?

The Windows OS is widely known for its user-friendly interface and broad software support. Commercial software developers usually prioritize Windows because of its extensive user base, resulting in a wider array of applications available for users. On the other hand, Windows can be more vulnerable to viruses and malware due to its popularity, which means maintaining regular system updates and employing robust cybersecurity measures is crucial.

- User-friendly Interface

- Broad Software Support

- Vulnerability to Malware

By contrast, Linux is renowned for its stability, open-source nature, and flexibility. This allows users to modify and tailor the OS to match their specific requirements. Yet, it’s worth noting that getting comfortable with Linux may require climb steep learning curve, which can be discouraging for first-time users.

Key features of Linux include:

- Open-Source Nature

- High Level of Customizability

- Demanding Learning Curve

In conclusion, whether you choose Windows or Linux mostly depends on what you need from an OS. Both options are reliable and widely used, though they differ in their interface, customizability, and software support.

Saving or Spending: Discussing the Economic Aspects of Your OS Choice

One of the first major decisions that a new computer owner must make is choosing the operating system (OS) to run on their machine. Which is Better for a First-Time User: Windows or Linux? Among the many choices, two platforms tend to stand out: Windows and Linux. You might be tempted to opt for the most well-recognized, but there are several aspects to consider — one of them being economic — that can significantly impact this decision.

Generally, Windows OS often comes with a cost tied to it, especially if you wish to upgrade to a superior version or need an additional license for different machines. On the other hand, Linux-based distros are predominantly free. However, it’s important not to make your decision purely on initial cost. Consider factors like:

- Software Compatibility: Proprietary software for businesses, such as Adobe Suite, are optimized for Windows and might not work seamlessly on Linux. Hence, one might need to consider the software costs while choosing the OS.

- Hardware Requirements: Linux generally consumes fewer resources, which could potentially extend your hardware lifespan.

- Support: Windows has wider tech support, whereas Linux communities depend on voluntary support; choosing a paid support plan would increase the costs.

| Factors | Windows | Linux |

|---|---|---|

| Initial Cost | $$ | Free |

| Software Compatibility | High | Variable |

| Hardware Requirement | High | Low |

| Support Availability | High | Community-based |

While the up-front price tag on Linux might be more appealing, remember to calculate all potential costs associated with both systems. Only then can you make an informed economic decision about your OS.

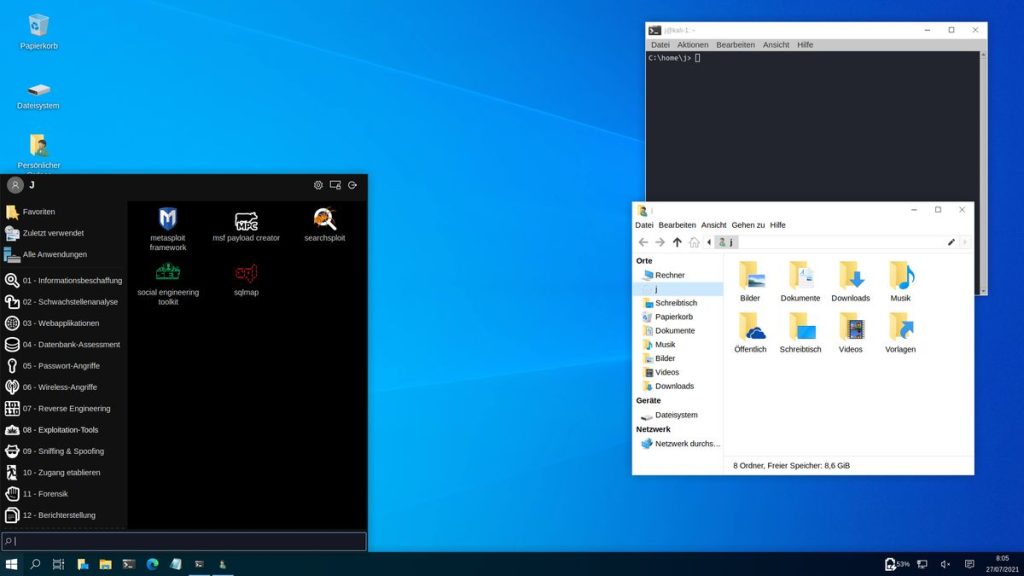

Fulfilling Technical Needs: Suitability of Linux and Windows for Specific Tasks

In your journey to find a perfect fit in terms of the operating system, you will undeniably stumble upon the two archrivals in the industry, Linux and Windows. Which is Better for a First-Time User: Windows or Linux? Each has a unique set of strengths and weaknesses that may make it more suitable for certain operations as compared to its counterpart.

For hardcore coding enthusiasts, Linux is undoubtedly a better match. It offers unlimited freedom to experiment, which means you can customize and reprogram it to adapt to any project. This is why Linux is a favorite for developers and system administrators. An extensive range of useful commands, elevated control and security, and the ability to run securely on older, less powerful hardware make it delightful for tech-savvy users. Moreover, it’s open-source, hence free, although support services and distributions often come at a price.

- Coding: Unparalleled customization flexibility

- Command functionality: Extensive control

- Security: Well-guarded system

- Cost-effectiveness: Most distributions are free

Conversely, legacy users and everyday consumers might prefer Windows. It’s a user-friendly operating system compatible with almost all software on the market. Due to its prevalence, Windows receives developer attention which translates into a wider range of available applications. Plus, compatibility with a broader spectrum of hardware devices, intuitive GUI, and solid customer support makes it a go-to choice for regular consumers.

| Software compatibility: | Extensive range |

|---|---|

| User interface: | Intuitive and friendly |

| Customer Support: | Substantial |

Mission Accomplished: Making the Final Decision between Linux and Windows

Which is Better for a First-Time User: Windows or Linux? At the end of this thrilling journey of discovery through the world of operating systems, we can proudly say: mission accomplished! Now that you are armed with all the necessary information, you can confidently make your choice between Windows and Linux.

For those who crave familiarity and ease of use, Windows is often the go-to choice. Its wide acceptance and usage makes software compatibility less of an issue, while the professional tech support available can be a lifesaver for less tech-savvy users.

- Familiarity: Windows boasts a friendly, familiar interface that many users appreciate. Plus, if you’ve used Windows on a previous device, you’ll probably feel right at home.

- Software Compatibility: Windows is compatible with a vast range of software applications, making it the go-to for gamers and professional users.

- Tech Support: With Windows, technical support is just a phone call or a click away. As a globally accepted product, it’s tech support coverage is highly commendable.

On the other hand, Linux is often the choice for those who love the freedom to customize and value open-source software. It’s also ideal for developers, system administrators, and those who are comfortable digging deep into the mechanics of an operating system.

| Customizable: | Open-Source: | Purpose: |

|---|---|---|

| With Linux, the opportunity to personalize is unparalleled. Almost every aspect of the system can be altered to suit the user’s needs. | Linux exemplifies the essence of an open-source operating system, which fosters a community of developers working tirelessly to improve its functionality. | The power and flexibility of Linux makes it the preferred choice for developers and system administrators. |

All in all, the decision between Windows and Linux boils down to your individual needs and preferences. By assessing your style of work, the purpose you need it for, your tolerance for learning new systems and the level of resources you can dedicate to your operating system, you can make an informed choice that best serves your computing needs.

Final Thoughts

Which is Better for a First-Time User: Windows or Linux? As we slowly slide our cursor to the end of this digital exploration, the echoes of the Windows chimes and Linux penguin chatter blend harmoniously. Choosing between these two titans of the operating system world can be a daunting task, a binary conundrum both for the technophile and the technology novice.

At the digital crossroads, remember that the key isn’t in selecting the ‘best’— for neither Windows nor Linux holds that universal title. Rather, it lies in recognizing the path that most resonates with your personal or professional needs, your tech-savviness, and yes, even your adventurousness to unfurl new layers of the computer realm.

Remember, it’s not just an operating system; it’s a herald of your binary journey, a digital companion for your bright new chapters. Whether you find your echo in the familiar hues of Windows or the underdog charm of Linux, step forth boldly. Your perfect OS awaits.

Aleksandar Paunovski is a Computer Science student at New Bulgarian University. He has more than 20 years of experience with computer systems. Aleksandar knows PHP, JavaScript, C++, CSS, and HTML and is an expert on WordPress, computer security, Linux, Mac OS, Chrome OS, and Windows. When not busy making sites, Aleksandar loves to listen to 90’s music, walk in the park, and post on his blog.